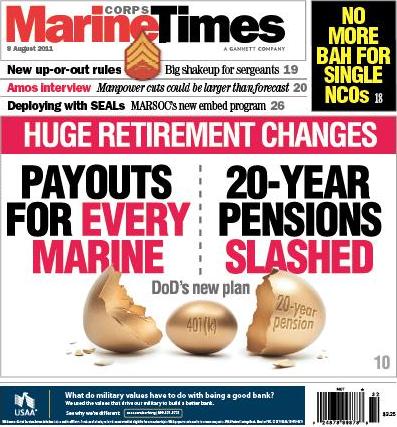

The Military Times put it on the Front Page last Week: Wednesday Secretary of Defense Leon Panetta announced at the National Defense University that no changes were coming soon. Despite that Military personnel should be on guard as the Defense Business Board continues to push for retirement changes that are bad for the service member, bad for keeping the best people in the military but that are great for Wall Street and Defense Contractors

There is much talk amid the current debate on the National Debt and the budget crisis of changing the military retirement system. Of course the argument now being used by the most fervent advocates of change is that military retirement is a “rich entitlement program” which is draining the Defense Budget and keeping us from buying weapons, to quote Defense Business Board member Richard Spencer “What are you going to trade off — a rich entitlements program, or boots and bullets for the troops?”

Now on the surface that seems logical but in truth it is simply a way for American business and financial corporations to gain control of military retirement for their own gain. The way they propose is to eliminate the current program and institute a 401K based system as used in many businesses. However they fail to mention that military service in time of war, which if anyone hasn’t noticed we have been at for 10 years is quite different than working in the civilian world, the little things like long deployments, family separation and need I say getting shot at by bad guys and watching your friends and comrades be killed our maimed do tend to make military service more arduous than 99% of those that work in the civilian world.

The ideas put out by the Defense Business Board gut the military retirement system. These plans are not in any sense of the word an “overhaul” of the system but a complete scrapping of a system that has worked. The members of the board seem to believe that the problem with the military budget is that military personnel make too much money and that their retirement if they get to 20 years is breaking the budget. The members of the board blame cutbacks in weapons systems on the personnel budget ignoring that most of the weapons systems cancelled or cut back were due to the massive cost overruns charged by defense contractors and the failure of those contractors to deliver the systems that they promised on time on budget or for that matter operational.

That list includes the grounded F-22 Raptor of the Air Force, the mechanically challenged LPD-17 San Antonio class amphibious ships, the under armed, undermanned and corrosion prone Littoral Combat ships which are actually two distinctly different classes of ship increasing the cost of the project. Then there is the FA-35 Joint Strike Fighter which is way over budget and far behind schedule and despite all efforts none are in operational units yet and those in test units were grounded last week. The Marine Corps lost the much touted but never produced Expeditionary Fighting Vehicle, the planned replacement for its Assault Amphibian Vehicle when the troubled and expensive program was cancelled by former Secretary of Defense Robert Gates. The Army had to cancel their Future Combat Systems Manned Vehicle project in 2009. The list can go on and on and on all the while the contractors that were involved made a mint off of the military. Much was due to the fact that all of these systems were over budget, behind schedule and often under performing what they were designed to do.

Something else that the Defense Business Board ignores is the massive cost of the wars in Iraq and Afghanistan and the money being paid to civilian defense contractors such as Halliburton, Kellogg Brown and Root, the former Blackwater and hundreds of other players in the dash for Defense Department cash. They also fail to mention that the financial industry which a number of heavy hitters on the board represent ran our and the world economy onto the rocks back in 2008.

The Defense Business Board was established by former Defense Secretary Donald Rumsfeld in 2001. All of the members are appointed by the Secretary of Defense and all of the current board members were appointed by Rumsfeld or Robert Gates.

So who are the members of this board and who do they work for?

John B. Goodman, Chairman: Serves as managing director of the U.S. Defense portfolio for Accenture, a global management consulting, technology services and outsourcing company.

Mark H. Ronald, Vice Chairman: As senior advisor to Veritas Capital Management is a private equity fund that invests in a broad range of middle market companies through buyouts, growth capital investments, and leveraged recapitalizations. Veritas Capital invests in companies that provide outsourced services to the government – primarily in the areas of defense and aerospace, security, and infrastructure. It has also earned a reputation as a niche defense investor and for turning around troubled defense contractors.

Fernando Amandi: The former Chief Operating Officer for Citibank Consumer Bank International inLatin America, President of Motorola International Network Ventures based in London, England and Senior Vice President and General Manager of the American Express Consumer Financial Services Division in Latin America. At present, he is the President of Fanta Real Estate Investments, LLC. He served for 6 years as an enlisted member of the Florida Army National Guard.

Owsley Brown II: Retired chairman and CEO of Brown-Forman Corporation. He served from 1966 to 1968 as an Army intelligence officer at the Pentagon.

Pierre A. Chao: Managing Partner and co-founder of Renaissance Strategic Advisors. The company website gives this description “Renaissance Strategic Advisors is focused on the global defense, space, government services, homeland security and commercial aerospace market. Our clients are typically senior decision makers at the Board of Directors, CEO, CFO, sector president or investment partner level. We work with firms up and down the value chain, from component manufacturers to prime contractors to private equity/venture capital firms. Our clients span the full life cycle from early stage startup firms to industry leaders.”

Patrick W. Gross: Chairman of the Lovell Group, a private investment and advisory firm, where he works with a portfolio of venture capital backed private technology and internet commerce companies. He is currently a director of four public companies: Capital One Financial Corporation, Career Education Corporation, Liquidity Services, Inc., and Mobius Management Systems, Inc. In the 1960’s he worked in the Pentagon as one of “McNamara’s Whiz Kids.”

Lon Levin: President of Sky Seven Ventures, which works with, helps manage, and invests in new technology companies, particularly space-based businesses, including Sentinel Satellite (CEO), Transformational Space (Chief Strategic Officer), Slacker Radio (Senior Advisor to CEO and Board), Integral Systems, Terrestar Networks, and Near Earth LLC.

Bonnie Cohen: A consultant specializing in management and financial issues. Ms. Cohen serves on the Board of Cohen & Steers Mutual Funds, a $20 billion dollar family of mutual funds. Ms. Cohen is a member of the Cosmos Club and on the Endowment Investment Committee.

Mel M. Immergut: Chairman of Milbank, Tweed, Hadley & McCloy LLP “a global law firm, with approximately 550 lawyers who provide a full range of financial and business legal services to many of the world’s leading financial, industrial and commercial enterprises, as well as governments, institutions and individuals.”

Edward A. Powell Jr.: President and CEO of the USO World Headquarters.

David H. Langstaff: President & Chief Executive Officer TASC, Inc. A technology and intelligence services a subsidiary of Northrop Grumman and Litton industries, both major Defense contractors.

Phil Odeen: Non-executive Chairman of AES, an international energy company and Convergys, a leading outsourcing company. Convergys is one of the leading firms that help companies in the United States and Western Europe outsource jobs overseas.

Arnold Punaro: Chief executive officer of the Punaro Group, LLC, a Washington-based firm offering government relations, strategic planning, federal budget and market analysis, communications, crisis and emergency management, business development and sensitive operations consulting. Punaro retired from the Marine Corps Reserve as a Major General and unlike the rest of the board served in combat as a Rifle Company Platoon Commander where he was awarded the Bronze Star for Valor and the Purple Heart Medal. He was mobilized for the Gulf War, the Bosnia operations and again at the beginning of Operation Enduring Freedom. Since his retirement he has been a consistent critic of the military retirement system.

Richard Spencer: Managing Director of Fall Creek Management LLC a privately held management consulting company. He was the former Vice Chairman and Chief Financial Officer of Intercontinental Exchange, Inc. (NYSE-ICE) which according to its website “operates leading regulated exchanges, trading platforms and clearing houses serving global markets for agricultural, credit, currency, emissions, energy and equity index markets. ICE operates three futures exchanges including London-based ICE Futures Europe, which hosts trading in half of the world’s crude and refined oil futures contracts traded each day. ICE Futures U.S. and ICE Futures Canada list agricultural, currency and Russell Index futures and options markets. ICE also provides trade execution, processing and clearing services for the over-the-counter (OTC) energy and credit derivatives markets.” Spencer served as a Marine Corps Aviator from 1976-1981.

Bobby Stein: President of the Regency Group, a family holding company located in Jacksonville,Florida. The Regency Group has invested in many businesses including the water, sewer and waste, real estate, mortgage service, and fast food industries.

Robert I. Toll: is Chairman and Chief Executive Officer of Toll Brothers, Inc., the leading builder of luxury homes

Atul Vashistha: Founder & Chairman, neoIT Founder & Chairman, NEOGROUP. According to the Defense Business Board website he is “a leading proponent and practitioner of globalization and futurizing enterprises. He is recognized globally as one of the leading advisors on globalization and outsourcing. He founded Neo Group (Formerly neoIT) in 1999 with the mission of helping enterprises grow their business and improve operations by leveraging outsourcing and globalization. Neo also advises government and trade bodies on how to be better destinations for outsourcing. Neo also help enterprises manage and monitor supply relationships, risks and governance.”

Kevin Walker: Chief Operating Officer of Iberdrola USA a public utility company and subsidiary company of the Spanish Electric Company Iberdrola. Walker is a 1985 graduate of theUnited States Military Academy and served as a Field Artillery Officer from 1985-1991 including a tour during Operation Desert Shield and Desert Storm.

Joe Wright: Senior Advisor to the Chart Group, L.P. which is a merchant banking firm investing in both venture and growth capital companies that also provides senior level advice and capital access to corporate clients. According to the company website it “is a merchant banking firm organized in 1994 to sponsor alternative investments and provide discreet, senior level advice and capital access to corporate clients.”

Jack Zoeller: Chairman and CEO of Bank of Virginia, a subsidiary of which he co-founded in 2009 to bring new capital and management to troubled community banks in the Eastern U.S. He has also served as CEO of Cordia Bancorp, Capital Risk Management Corporation, ComFed Bancorp Incorporated, North American Company Health and Life Insurance Company, and AtlantiCare Risk Management Corporation. Zoeller is a Military Academy graduate and former Infantry Officer who served with the 82nd Airborne Division.

John Hamre Chairman of the Defense Advisory Board and Chairman of the Defense Science Board serve in an ex-officio status.

Senior Fellows:

Neil F. Albert: President and CEO of MCR, LLC, a company specializing in management consulting, business analysis and forecasting, and information systems.

Barbara Barrett: Former Ambassador to Finland until 2009. She is an international business and aviation attorney. CEO of Triple Creek Guest Ranch, a Montana Hideaway resort.

Denis Bovin: Co-Chairman and Co-CEO of Stone Key Partners LLC, a strategic and financial advisory investment bank which “offers mergers and acquisitions advisory services.” Prior to forming Stone Key Partners, Mr. Bovin was Vice Chairman –Investment Banking, Senior Managing Director and Chairman of the Global Technology, Media and Telecom Group at Bear Stearns & Co. He was a member of the team that directed Bear Stearns’ Investment Banking activities and had direct responsibility for a wide variety of the Firm’s key domestic and international investment banking clients.

Frederic W. Cook: Founding Director of Frederic W. Cook & Co., an independent consulting firm providing advice to corporate boards and compensation committees on executive compensation matters. The company website says that they provide “consulting assistance to corporations in order to develop compensation programs for senior executives, key employees, and board of directors.” Prior to forming the firm in 1973, Fred was a principal in Towers, Perrin, Forster & Crosby, a firm which he joined in 1966 following four years of service as an infantry officer in the U.S. Marine Corps.

Madelyn Jennings: A Founder of the Cabot Advisory Group, President of the McGregor Links Foundation, and Co-Chair of the Executive Committee of the Freedom Forum. She is the retired Senior Vice President of Personnel at the Gannett Co., the largest newspaper company in the U.S., publisher of USA TODAY. Previously she was Vice President of Human Resources at Standard Brands Inc.

Jim Kimsey: Created America Online, Inc. He currently serves as Chairman Emeritus. He attended theUnited StatesMilitaryAcademy atWest Point. He served three combat tours as an airborne ranger, two in Vietnam, earning various awards for service and valor.

William R. Phillips: Principal in Charge of KPMG’s Federal Advisory unit, located inMcLean,Virginia. In this role he is responsible for the development and execution of the unit’s business strategy, client services and business operations. His team supports clients across the Federal Government, representing most all agencies, including the Departments of Treasury, Energy, Defense, and Homeland Security, in addition to the intelligence community. Services include financial management improvement, strategy, IT security and internal controls, and supply chain management. Prior to joining KPMG, Mr. Phillips was a Vice President at IBM responsible for their services to the global defense community. While Mr. Phillips was not involved his company KPMG has been the focus of several major criminal and civil investigations. In early 2005, theUnited States member firm, KPMG LLP, was accused by the United States Department of Justice of fraud in marketing abusive tax shelters. KPMG LLP admitted criminal wrongdoing in creating fraudulent tax shelters to help wealthy clients avoid $2.5 billion in taxes and agreed to pay $456 million in penalties in exchange for a deferred prosecution agreement. KPMG LLP would not face criminal prosecution if it complied with the terms of its agreement with the government. On January 3, 2007, the criminal conspiracy charges against KPMG were dropped.

Dov S. Zakheim: Senior Adviser at the Center for Strategic and International Studies at the CNA Corporation a non-profit research organization that operates the Center for Naval Analyses and the Institute for Public Research. Previously he was Senior Vice President of Booz Allen Hamilton, where he was a leader in the Firm’s global defense practice. During the 2000 presidential campaign, he served as a senior foreign policy advisor to then-Governor Bush. From 2001 to April 2004 he was Under Secretary of Defense (Comptroller) and Chief Financial Officer for the Department of Defense. He chairs the National Intelligence Council’s International Business Practices Advisory Panel, and is a member of the Commission on Wartime Contracting in Iraq and Afghanistan; the Defense Business Board, which he helped establish.

Consultants:

John M. B. O’Connor: Chairman of J.H. Whitney Investment Management, LLC, which according to its website “pursues high absolute risk adjusted returns in a limited number of highly specialized investment strategies in the public markets. Our specific areas of excellence are Asian markets, Global Commodity and Macro markets, the US Equity Volatility complex and US Small Capitalization deep value equities.”

Leigh Warner: Senior Advisor to business leaders and government officials. Her biography on the DBB website is very vague as to what corporations that she worked for or managed except that she did at one time serve as Director for Marketing of Kraft Foods.

Admiral Vernon Clark USN Retired: Former Chief of Naval Operations sacrificed 30,000 Navy personnel and decommissioned dozens of ships early in order to “recapitalize” the fleet, something that never occurred. Current CEO of SRI International “an independent, nonprofit research institute conducting client-sponsored research and development for government agencies, commercial businesses, foundations, and other organizations. SRI also brings its innovations to the marketplace by licensing its intellectual property and creating new ventures.” On Board of Directors of Raytheon Company, Rolls Royce North America, Horizon Lines, and the World Board of Governors of the USO. He is a Distinguished Professor atRegentUniversity and serves as a Trustee at RegentUniversity,Vanguard University and Air University. He is a senior advisor with Booz Allen Hamilton, and is on advisory boards with the Defense Policy Board, Fleishman-Hillard, Northrop Grumman, Robertson Fuel Systems LLC, Cubic Defense Applications, Inc., and the Executive Committee of Military Ministry.

General Michael Carns USAF Retired: Served as Vice Chief of Staff of the Air Force from 1991-1994. In 1995 he withdrew his nomination to become director of the CIA when it was revealed that he had failed to properly compensate a young Filipino who legally accompanied his family to the United States, an act he said that was an “innocent mistake.” He currently serves as the Vice Chairman of Priva Source, Inc., a small software firm specializing in the security and de-identification of large, sensitive databases, in Weston, Massachusetts and serves on the Board of Directors for Virtual Agility, Inc.

Putting it all Together

Everyone knows that our country needs to put its financial house in order. However let us put a few things in perspective.

The 50% of Pay Retirement Myth: The 50% myth is widely circulated and most people wrongly assume that a military member that retires at 20 years gets 50% of their pay when they retire. First the 50% is actually the average of their highest three years of base pay, usually amounting to about 47% rather than 50%. A lot of people talk about the 38 year old retiree getting 50% of his or her pay for life. First only a fraction of enlisted members can retire that early and most of those are in the pay grades of E6 and E7. Many more especially officers, warrant officers and those that reach the E8 to E9 level stay longer meaning that they enter civilian life at a point where their age becomes a factor against them. Additionally all lose special pays and things like the Basic Allowance for Housing, combat pay and other benefits. This means that the average service member is only receiving about 35% of their active duty pay and allowances when they retire. Add to this the fact that many have incurred injuries including combat related injuries that follow them well past retirement. The board is also recommending cutting medical benefits with General Punaro calling them a “GM type benefit” that cannot be sustained.

Reserve Retirement: Reservists that qualify for retirement receive that pay at the age of 60 and only receive a fraction of what they would if they had 20 active years. Reserve retirement is calculated on actual days of active duty, points for inactive duty training (drills) and points for being in a drilling status. To have a “good year” for retirement a reservist has to accumulate 50 retirement points which can be any of the above plus points for correspondence or online courses offered by the military. Most reservists spend many more hours and days in unpaid status in order to maintain their qualifications and ensure that their units are able to do their mission.

Many Military job specialties do not have a civilian equivalent: Here is another fact that the Board and other civilian critics of the military compensation like to ignore. The way they market their proposal is to basically say that military retirement puts one on easy street and that veterans walk right into great jobs when they leave the military. The unemployment rate for veterans is far higher than the national average as are medical and psychological problems related to their service.

What would replace the current system? A mandated program similar to a 401K which invests the service member’s contributions estimated at about 16% a year into mutual funds and the stock market. The Board’s plan reduces retired pay 5% for each year before age 57 (17 years x 5% = 85% reduction), yielding only $3,600 a year at age 40 for an E7 at current pay rates. At age 60, the retiree would begin drawing money from the 401(K)-type plan. Using their assumptions that project a 7% return on the investment, the retiree would draw $13,600 more per year until age 85. If the member wanted to withdraw money after age 85, the annual withdrawal amount would be reduced. Now the plan would provide a limited benefit to those that leave the service before the 20 year mark and that is a plus for those service members.

Retaining Qualified People: The retirement system is a huge part of our military’s success. It encourages well qualified people who could be making more money in the civilian world to stay in the military. Back in the 1980s Congress passed a retirement reform plan that reduced the 20 year retirement benefit to 40% of the high three years. Secretary of Defense Weinberger said that it would make it hard to retain qualified people. Congress passed it and during the Clinton administration had to return to the 50% high-three plan because we were losing too many of our best people. To use a rather quaint term “you get what you pay for.”

Follow the Money:

The crux of the Defense Business Board’s proposal is to make military retirement like civilian retirement. The only problem is that civilian firms generally don’t have a “retirement plan” anymore. Instead they make minimal investments in 401K programs which leave their “retirees” at the mercy of the economy and the markets. I know many people in their 60s and 70s that have seen their nest eggs blow away in the latest market turmoil. This is not exactly a secure investment especially when these same retirees will certainly face the reduction or elimination of their Social Security benefits that they like all people (except the miniscule number that can opt-out of it) contribute.

So it really isn’t the service member that benefits from this plan. Likewise if you admit that like in the 1980s and 1990s we will lose a lot of our best people if the retirement benefit is removed or substantially reduced with the resultant loss in experience and expertise and the effect on combat power.

So who benefits? Follow the Money: The reason that I put all the board member names and who they work for and what their connections are is so you can follow the money. I have not seen any other articles or blogs that really trace this to the source. Almost every single member, fellow or advisor has significant ties and relationships with major defense contractors or Wall Street forms that deal in mutual fund management, investment and businesses that focus on outsourcing. All were appointed by either Secretary of Defense Rumsfeld or Gates and represent institutions that are closely allied with the business interests of the Republican Party. Those that say that “Obama is threatening to cut military retirement” either are ignorant or lying.

Since none of the Board members are employees of the government and only are reimbursed for their per diem they are not fair arbiters. They represent the very firms on Wall Street and the Defense Industry that will gain the most from this plan. Almost all are so deeply enmeshed in what Dwight D. Eisenhower called the Military Industrial Complex that their ultimate loyalty is to those that they work for, those very firms that have swindled and cheated the government by their mismanagement and inefficiency in building weapons systems that are over budget, behind schedule and often cannot be fielded, have to be cancelled or truncated or are failures that cannot perform the mission that they were designed to do. Likewise they represent the major financial interests that were hat in hand responsible for the financial meltdown of 2008, our record unemployment and possible double dip recession. The firms that these men and women represent would receive a cash infusion of major proportions coming from the forced contributions by a million and a half active and reserve military members.

To his credit the new Secretary of Defense Leon Panetta said on Wednesday that there would be no changes coming soon and any changes will have to be passed by Congress.

Conclusion: We have been at war for 10 years and in various states of war or peace making operations for 20 years. During that time only about one half of one percent of the American population served in the military at any given time. To insinuate that the military personnel who have borne the brunt of these wars are greedy, overpaid or self serving is obscene and to imply that they veteran’s organizations that go to bat for the serviceman or women are working against our national security by fighting for military personnel is unconscionable. For the members of this board to suggest that somehow what military personnel receive in compensation is too much and the benefits too generous should look in the mirror. The retired military members of the Board have not given up their retirement and are all connected with the major defense contractors and financial institutions that would benefit the most from this plan. Many of the corporate members have been living off of other people’s money and government contracts almost all of their professional lives. They are the people that pay lobbyists to ensure that they get tax breaks even as they collect every government contract and service that they can take.

I do not know any of the people on the board and many are philanthropists and some donate time and money to organizations that honor the military. I am not saying that these are bad people. I simply am saying that they represent their interests and those of the corporations that they run or that employ them. It is what is called “crony capitalism.”

Follow the money my friends follow the money.

Peace

Padre Steve+

Note: All information in this article regarding the members of the committee comes from the Defense Business Board website, the corporate websites of the various organizations that employ them and various business periodicals and publications on the web.